Automotive Dealerships

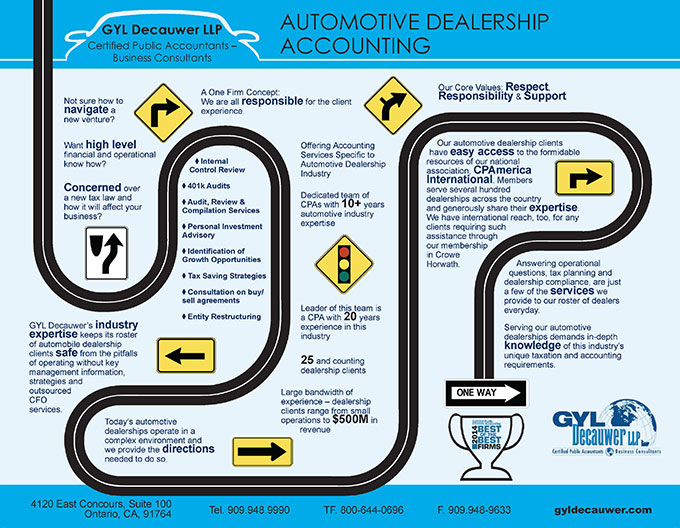

Automotive Dealership Accounting

Serving our automotive dealerships demands an in-depth knowledge of this industry’s unique taxation and accounting requirements. From understanding the ever-changing factory financial statement filing requirements to inventory valuations to industry specific software, we take care of our dealers. Our specialists help you protect your assets, identify opportunities for growth and present tax savings strategies.

CTA – Accolades

Our acquired level of expertise in this complex industry, ensures you are on the right path with your dealership. We assist you in realizing your organization’s full potential, minimizing tax liabilities and maximizing cash flow.

Automotive dealership clients of our Firm have easy access to the formidable resources of CPAmerica International, a national association of independent CPA and consulting firms in which we are members. The CPA firms of this association serve several hundred dealerships across the country and generously share their expertise to solve complex issues that face automotive dealerships everyday. GYL capitalizes on these relationships so as to best serve its clients. For those dealerships requiring international expertise, the Firm is affiliated with Crowe Horwath, the international arm of CPAmerica International.

Testimonial

We can help you successfully navigate the constantly evolving automotive industry. Our niche services include, amongst others:

- Audit and accounting services

- Compliance auditing

- LIFO inventory calculation and compliance service

- Inventory controls

- 263A Cost capitalization calculations

- IRS Change of accounting filings

- Dealership valuation studies

- Review and consultation on buy/sell agreements

- Employee benefits and deferred compensation agreements

- Internal control reviews

- State and local tax consulting

- Government tax incentives

- Estate planning

- Business succession planning

- Personal investment advisory services

- Executive compensation issues

- Bank reconciliation services

- Tax free exchanges

- Form 8300 compliance

- Tax planning and compliance

- Dealer applications

- Fixed asset analysis and cost segregation studies

- Personal financial statements

- Payroll and property tax returns

- Interim schedule cleanup

- Operational reviews

If you would like more information on how we can help you, please contact Adam Francis at [email protected].

Schedule your FREE Consultation